Specialist medical accountant David Lockitt* offers some tips on checking the practice’s monthly statements for payments and deductions

With the increasing reliance on the calculation of practice payments based on data automatically extracted from the practice’s records, and also changes in when income is paid, it is essential that practices review their GMS/PMS statements on Open Exeter each month and reconcile them to the money received into their bank accounts.

Another reason for checking these statements carefully is to flush out any incorrect adjustments for superannuation. This has recently become an issue for both partners and salaried GPs. With delays in updating records for new starters and for GPs opting in or out of the NHS Pension Scheme, and also for end of year certificate adjustments, a complete review of the summary statement of payments will help practices check that adjustments are correct and reflect their communications with Primary Care Services England (PCSE).

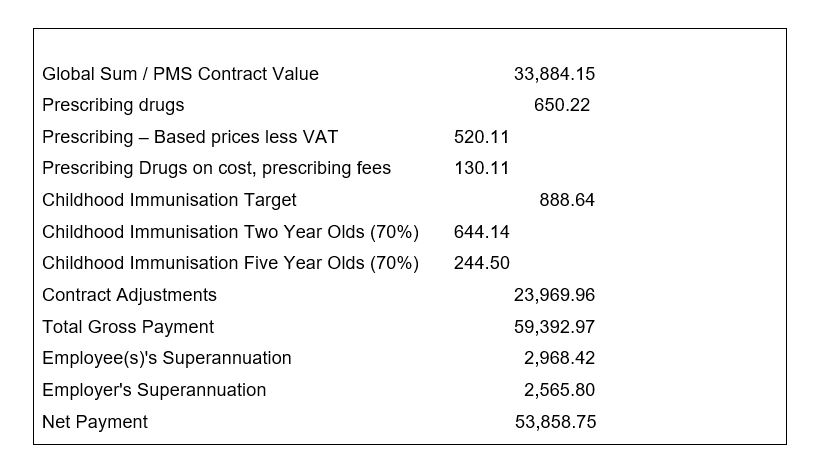

Here is an extract showing the summary from an Open Exeter June 2020 statement of payments, with notes below to explain each heading:

Global Sum / PMS contract value

This is recalculated every three months based on a “normalised weighted” practice list size. The calculation is based on the Carr-Hill factors, including the local area average population, age/gender and rurality. For 2020/21 the GMS payment is £93.46 per weighted patient. PMS payments may be different due to local circumstances.

Further adjustments are made for additional service opt-outs such as out of hours, temporary residents and London weighting allowance. Note that from April 2020 any Correction Factor (Minimum Practice Income Guarantee) income ceased.

Prescribing drugs and childhood immunisation

Childhood immunisation data are extracted directly each quarter from the practice’s records. Payments are currently based on a 90% target, with a large reduction in income every quarter if the target is not met. The system is due to change from the target-based approach to more fully reflect work carried out.

Drug reimbursements are based on claims made by the practice for cost and fees for drugs prescribed.

Contract adjustments

Income includes enhanced service income, aspiration payments, notional/cost rent, rates, QoF and minor surgery claims.

Deductions include statutory and voluntary levy contributions, for example LMC subs.

Any historic superannuation adjustments for partners who have left the practice and in year corrections for current partners will be included here, along with other adjustments such as rent arrear catch-up payments.

Superannuation

Superannuation contributions are summarised by individual GPs and non GP partners. Monthly deductions for both employee and employer contributions are shown, along with any additional voluntary contributions.

Any end of year superannuation adjustments should also be shown here.

Additional statements

As well as the Statement of Payments on Open Exeter, practices receive separate statements each month for local enhanced services and other NHS reimbursements.

Sometimes, money coming into the practice’s bank account can be a combination of these statements, so it is important to reconcile what has been physically received against statements each month to ensure the practice is receiving everything it is expecting. Where there are differences practices should chase them up and submit queries.

Monthly action list

Here are my key tips for managing this work:

- Reconcile money in against remittances and statements on a monthly basis.

- Keep a summary of statements by month so you can see patterns and identify gaps in income

- Ensure CQRS claims agree to the practice’s system

- Use templates to help with coding

- Use searches to check claims

- Claim on time

- Check that the raw list size each quarter is correct

- Check FP34D date for submissions made to make sure scripts and forms numbers agree

- Review superannuation deductions taken

- Have new GPs/partners had deductions taken?

- Have payments ceased for retired or opted out GPs/partners?

- Do annual adjustments agree to superannuation certificates submitted?

- Have certificate adjustments been made?

*David Lockitt’s firm is a member of the Association of Independent Specialist Medical Accountants.

January 22, 2021 at 10:30 am

I’m afraid childhood imms figures are not automatically extracted from the clinical system in the case of s1 (cannot vouch for other providers). You need to output Immunisation Targets to a CSV spreadsheet and upload that to Open Exeter.

November 2, 2021 at 10:22 am

Can anyone explain the new GPP Payments statement?

Why is London Weighting Allowance there? It has only appeared since June when we said goodbye to Open Exeter and hello to GPP statements

March 3, 2022 at 12:38 pm

I am struggling to reconcile my GPP Payments / Drugs / Number of Prescriptions to my FP34 submission for a given dispensing month, can you help please?